BEATS BANKRUPTCY AND DEBT CONSOLIDATION!

What is Wisconsin Chapter 128

You may have heard that, in Wisconsin, we have a unique law that lets people in debt obtain virtually the same kind of legal protections against creditors and their collections agencies that filing for bankruptcy provides.

About Chapter 128

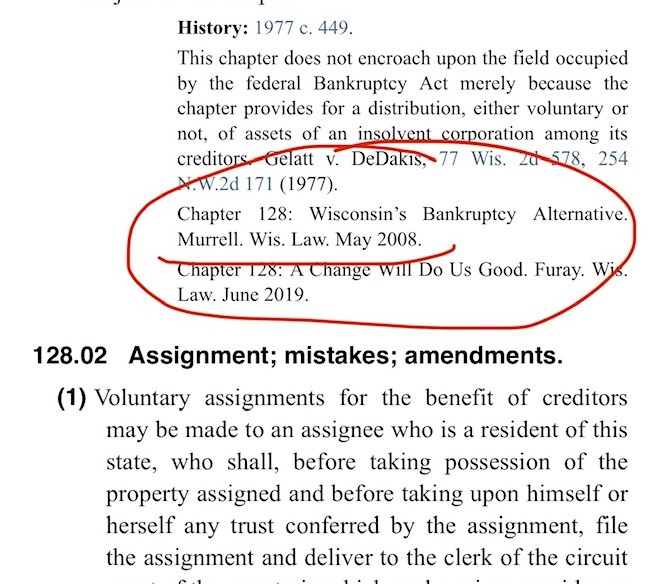

My name is Jeff Murrell, and I’ve been helping people prepare and file these cases from my office in Milwaukee all over Wisconsin since 1998. I’m only the third person in history to publish about this unique law – scroll down to my article link in Wisconsin Lawyer below. I give folks free, unlimited telephone, text and email consultations to help them figure out if Chapter 128 is right for them. Filing bankruptcy can cost you generally between $1,500 and more than $3,000 these days!

If you live anywhere in Wisconsin, I can help you get the bankruptcy-like protection filing Ch. 128 provides for less than only about ⅓ of the upfront cost of filing federal bankruptcy, without the invasive, nosy hassle that comes with filing federal bankruptcy. It’s cheap, quick and easy!

Typical debts that can be handled through a Ch. 128 include:

- Overdue Utilities*

- Accounts in Collections

- PayDay/Check N’ Go loans

- Credit Cards

- Medical Bills

- Personal Loans

- Wisconsin Taxes*

- Child-Support Arrears*

- Repossessed-Vehicle Loan Deficiencies

- Civil Judgments

- Wisconsin Tickets/fines

- Practically anything other than car, home or other secured loans!

*May not preclude interest and penalties.

Chapter 128 FAQ Section

I can get the forms online, fill them out and file them myself, so do I really need to retain you to file one of these?How much does it cost?

Without question, YES! Although Milwaukee County Circuit Court and other lawyers have made their particular versions of the petition documents available on their websites for you to download, there are a wide variety of complicated issues that can arise during the course of your Chapter 128 that absolutely require legal expertise and training to deal with (there are many, many more questions that can arise for you than what appear here on my little FAQ list). It’s not just a simple matter of filling out paperwork and paying a court filing fee; I have the years of experience required to effectively and quickly custom draft court documents to deal with problematic creditors, issues that may arise with your appointed trustee and even with your assigned judge. There are no “forms” for that! I can seamlessly make adjustments to your debt load after you fill out that paperwork, file it and then want to make changes to it, bring contempt and other proceedings against listed creditors who don’t believe they can get into trouble for harassing you or actually refuse to accept payments from the trustee or otherwise try to frustrate your filing, I can easily deal with court and creditor staff that you cannot without enormous effort, and I have basically every answer to almost any question that arises after filing that you get automatically and quickly when you retain me, but that people who don’t retain me right off the bat don’t get without paying me a pretty steep hourly fee when they eventually get in too far over their heads with their self-filing, and reach out to me to help bail them out of trouble (which can end up costing someone a whole lot more than if they had just retained me to draft their paperwork and file for them in the first place)! It can actually be far cheaper to hire me to do this for you, rather than trying to do it yourself. Even other lawyers ask me to help them with these because they don’t want a “fool for a client!”

How much does it cost?

Court filing fees get raised from time to time, but it is only around $100 in every county to file as of early 2025. Please email me to request my initial instructions which set forth how much my document-preparation fees cost.

What will my monthly payments be?

The rule of thumb is that there is about a $300 monthly payment for every $10,000 of debt you want to include in your Ch-128 plan (which includes all attorney fees and trustee administration expenses which you also pay through your plan). Call or email me for an exact estimate of what your monthly payments would be with the debts you wish to include.

I get paid bi-weekly (every two weeks). Will each of my monthly Ch-128 payments get split evenly between both my monthly paychecks?

Yes

Do the payments have to come out of my payroll checks from my job and does my employer have to know that I'm doing this?

Normally, yes – but I offer clients an option for sending in their payments directly to the trustee’s office themselves as a “self-pay,” keeping their employers and nosy co-workers out of it entirely.

How long does the process take?

I can usually get your paperwork all ready within two days (often times the same day – I work really fast) after you submit the required personal and creditor information that I need. After the initial pleadings are signed and notarized, it normally takes about a week to file the case. It then takes the trustee several weeks after that to get your monthly payments going. You do not have to pay your listed creditors or the trustee’s office before then. (If you do not hear anything from the trustee in a month after filing, get a hold of one of us to find out what’s going on with your case – court clerks sometimes misplace or even lose the court files, and those long delays in getting essential paperwork back to us results in higher monthly-payment amounts for the client than originally determined!)

Contact Me Today

I help people file Chapter 128 cases in Eau Claire, Madison, Milwaukee, Racine, Green Bay, Kenosha and surrounding areas in Wisconsin.

Want to know how to file for Chapter 128 in Wisconsin? Just email, call or text me!

jeffmurrell@lawyer.com

TEL/TEXT: 414-372-6598